3 'Bollinger Bands' Crypto Trading Methods

- Description

- Curriculum

- Reviews

It’s Never Been Easier To Win Crypto Trades Than Right Now…

Discover The Fastest & Easiest Way To Create Money With Top 3 ‘Bollinger Bands’ Crypto Trading Methods…

What Are Bollinger Bands:

Bollinger Bands are a type of statistical chart characterizing the prices and volatility over time of a financial instrument or commodity, using a formulaic method propounded by John Bollinger in the 1980s.

Financial traders employ these charts as a methodical tool to inform trading decisions, control automated trading systems, or as a component of technical analysis.

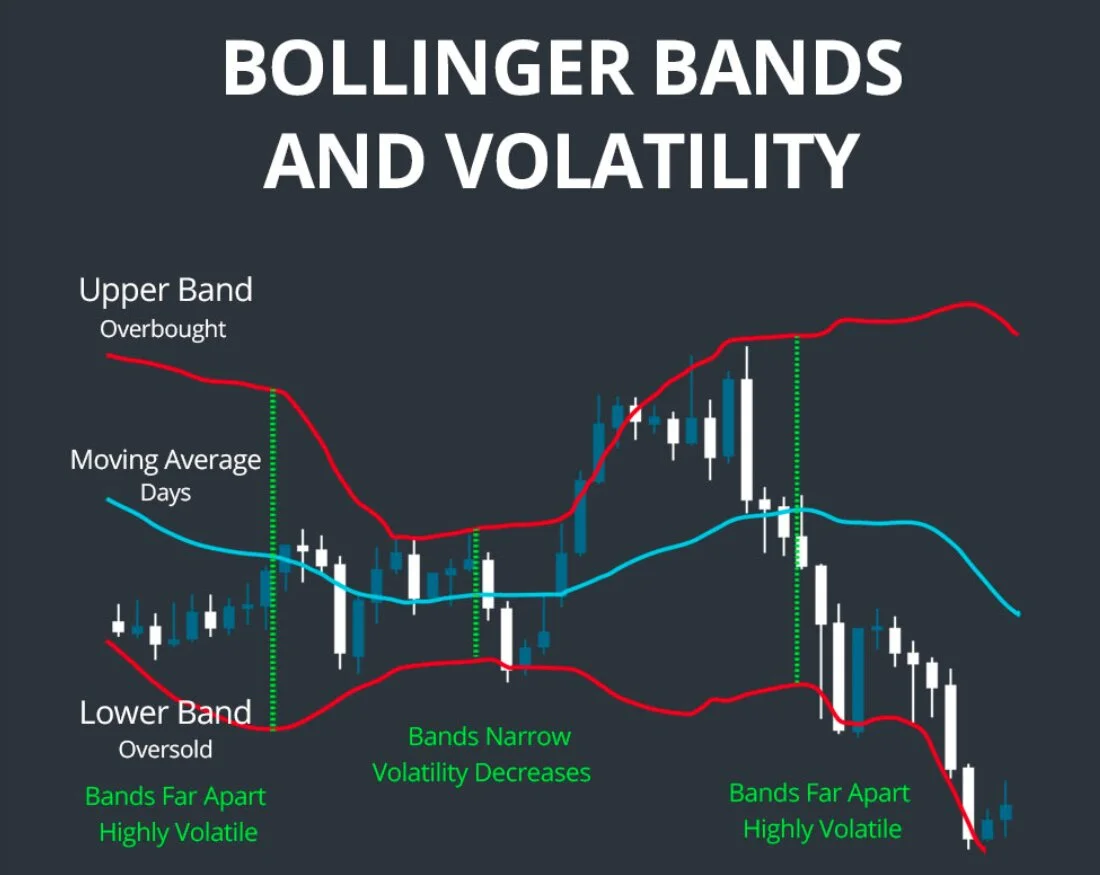

Bollinger Bands display a graphical and volatility (expressed by the width of the envelope) in one two-dimensional chart as shown below…

The purpose of Bollinger Bands is to provide a relative definition of high and low prices of a market.

By definition, prices are high at the upper band and low at the lower band.

This definition can aid in rigorous pattern recognition and is useful in comparing price action to the action of indicators to arrive at systematic trading decisions.

The use of Bollinger Bands varies widely among traders.

Some traders buy when price touches the lower Bollinger Band and exit when price touches the moving average in the center of the bands.

Other traders buy when price breaks above the upper Bollinger Band or sell when price falls below the lower Bollinger Band.

When the bands lie close together, a period of low volatility is indicated.

Conversely, as the bands expand, an increase in price action/market volatility is indicated.

When the bands have only a slight slope and track approximately parallel for an extended time, the price will generally be found to oscillate between the bands as though in a channel.

Traders are often inclined to use Bollinger Bands with other indicators to confirm price action.

With that said, Bollinger Bands are really easy to understand and can give you good trading signals…

Bollinger Bands are great for beginners because they are easy to analyse!

The ‘Bollinger Profitz’ training will show you 3 different trading methods you can use, without any prior knowledge or experience…

From opening a trading account, to learning how to get in and out of trades, to taking profits, it’s all inside the ‘Bollinger Profitz’ training…

Here Is What You Will Learn From This Course:

#1: How to set-up a trading account & transfer funds to it

#2: How ‘SPOT’ Markets work

#3: How ‘FUTURES’ Markets work

#4: How ‘LEVERAGE’ works in tandem with time frames

#5: How to use ‘TradingView’ to monitor trades accurately

#6: How to set stop-losses/take-profits properly when entering trades (Part #1)

#7: How to set stop-losses/take-profits properly when entering trades (Part #2)

#8: Setting-up your indicators for the ‘Bollinger Profitz’ methods to work for you

#9: ‘Bollinger Profitz’ Trading Method #1

#10: ‘Bollinger Profitz’ Trading Method #2

#11: ‘Bollinger Profitz’ Trading Method #3

Throughout this course, you will learn from the demonstrate steps which you’ll need to take to ensure you maximize your profits by using Bollinger Bands as your main trading indicator, so you can get good trade signals.

Bollinger Bands are important when it comes to earning a significantly higher income by trading crypto!

These are 3 REALLY EASY trading methods that can get you maximum profits by using them!

In this video series, you will discover the 3 Bollinger Bands trading methods…

This training is ideal for beginners who never traded crypto before…

See you inside

Course Feature Photo by Wance Paleri

- 1How to set-up a trading account & transfer funds to it

- 2How 'SPOT' Markets work

- 3How 'FUTURES' Markets work

- 4How 'LEVERAGE' works in tandem with time frames

- 5How to use 'TradingView' to monitor trades accurately

- 6How to set stop-losses/take-profits properly when entering trades (Part #1)

- 7How to set stop-losses/take-profits properly when entering trades (Part #2)

- 8Setting-up your indicators for the 'Bollinger Profitz' methods to work for you

- 9'Bollinger Profitz' Trading Method #1

- 10'Bollinger Profitz' Trading Method #2

- 11'Bollinger Profitz' Trading Method #3